Majid Al Futtaim Partners with Tabby: Transforming Shopping Experiences in the UAE with SHAREPay

Posted on September 3, 2024, by the LG Content Team

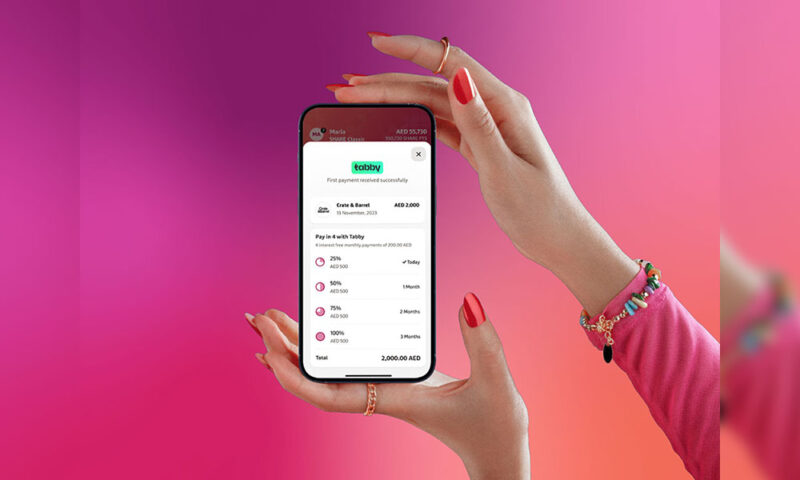

A new era of shopping is blossoming in the UAE, thanks to an exciting collaboration between Majid Al Futtaim, a leading shopping mall operator, and Tabby, a pioneering payments app. This partnership promises not just convenience but a reimagined retail experience powered by the Buy Now, Pay Later (BNPL) model, transforming how consumers engage with their favorite brands.

Enhancing Consumer Flexibility

Formed in July 2023, the strategic alliance between Majid Al Futtaim and Tabby was initially designed to introduce Tabby’s convenient payment solutions across Majid Al Futtaim-owned stores in the UAE. However, this summer saw the launch of a groundbreaking feature that integrates Tabby directly into the Majid Al Futtaim SHARE app, taking the concept of financial flexibility to new heights for customers shopping in the region’s popular malls.

With the introduction of the SHAREPay feature, shopping enthusiasts can enjoy a seamless experience that combines the extensive offerings of Majid Al Futtaim with the dynamic payment solutions provided by Tabby. Whether you’re looking to indulge in luxury fashion or add to your home décor collection, the integration allows you to shop now and pay later, all within a user-friendly platform.

A Glimpse into the Numbers

The initial numbers from this partnership are impressive. Within just nine months of its launch, Majid Al Futtaim reported processing transactions totaling approximately AED 253 million through Tabby, significantly exceeding its Year 1 projections of AED 100 million. This surge in transaction volume speaks volumes about the growing consumer appetite for flexible payment solutions like the “Split in 4” option, which allows shoppers to divide their payments into manageable installments.

Khalifa Bin Braik, the CEO of Majid Al Futtaim Asset Management, commented on the success, stating, “This partnership underscores our commitment to innovation and excellence, ensuring that we constantly meet the evolving needs of our customers. We are confident that it will continue to positively impact our business and customer satisfaction in the years to come.”

Customer-Centric Features

So, what makes SHAREPay a game changer? Hosam Arab, Co-founder and CEO of Tabby, highlights key features that cater to modern shoppers: “This partnership provides their shoppers with additional payment choices and offers the ease, convenience, and security of SHAREPay alongside the features users love in Tabby—flexibility, transparency, and no hidden fees.”

This statement emphasizes a critical point in today’s retail landscape—consumers are increasingly seeking transparent financial products that align with their spending habits. With no hidden costs involved, customers can shop with confidence, knowing that their payment structure is straightforward and manageable.

Why BNPL is Gaining Traction

The rising popularity of BNPL services is not just a trend; it’s shaping the future of retail. Millennials and Gen Z consumers, in particular, are driving this shift as they seek convenience and flexibility in their financial transactions. This demographic prefers to avoid large lump-sum payments and is more inclined to select payment options that allow them to spread costs over time.

This growing preference makes collaborations like the one between Majid Al Futtaim and Tabby not only beneficial for consumers but also lucrative for businesses. As retailers recognize the importance of flexible payment solutions, the integration of BNPL features becomes a vital strategy to enhance customer experience and drive sales.

The Bigger Picture

Majid Al Futtaim’s integration of Tabby is part of a larger landscape in which technology and retail are converging to create smooth, enjoyable shopping experiences. By leveraging innovative financial solutions, malls can offer a unique value proposition that keeps customers returning.

As the UAE’s economy continues to grow and evolve, initiatives like these could redefine how consumers shop in physical environments, ensuring that brick-and-mortar stores remain competitive amid the rise of e-commerce.

A Bright Future Ahead

As we move forward, the collaboration between Majid Al Futtaim and Tabby is a sparkling example of how technology can enhance everyday consumer experiences. With a commitment to ongoing innovation and customer satisfaction, these industry leaders are poised to shape the future of retail in the UAE.

For shoppers in the region, this partnership represents more than just a shopping app; it’s a herald of financial flexibility that empowers consumers to enjoy the lifestyle they desire, minus the financial strain.

—

Tags: #BusinessNews #EconomyNews #UAE #RetailInnovation #BNPL

In summation, the partnership not only reflects the merging of payment technology with retail experiences but also underscores the importance of understanding consumer needs in today’s fast-paced shopping environment. As this trend takes hold, we can expect even greater advancements in how we approach both shopping and payment options.