Mubadala's Strategic Investments Redefine Sovereign Wealth Fund Landscape

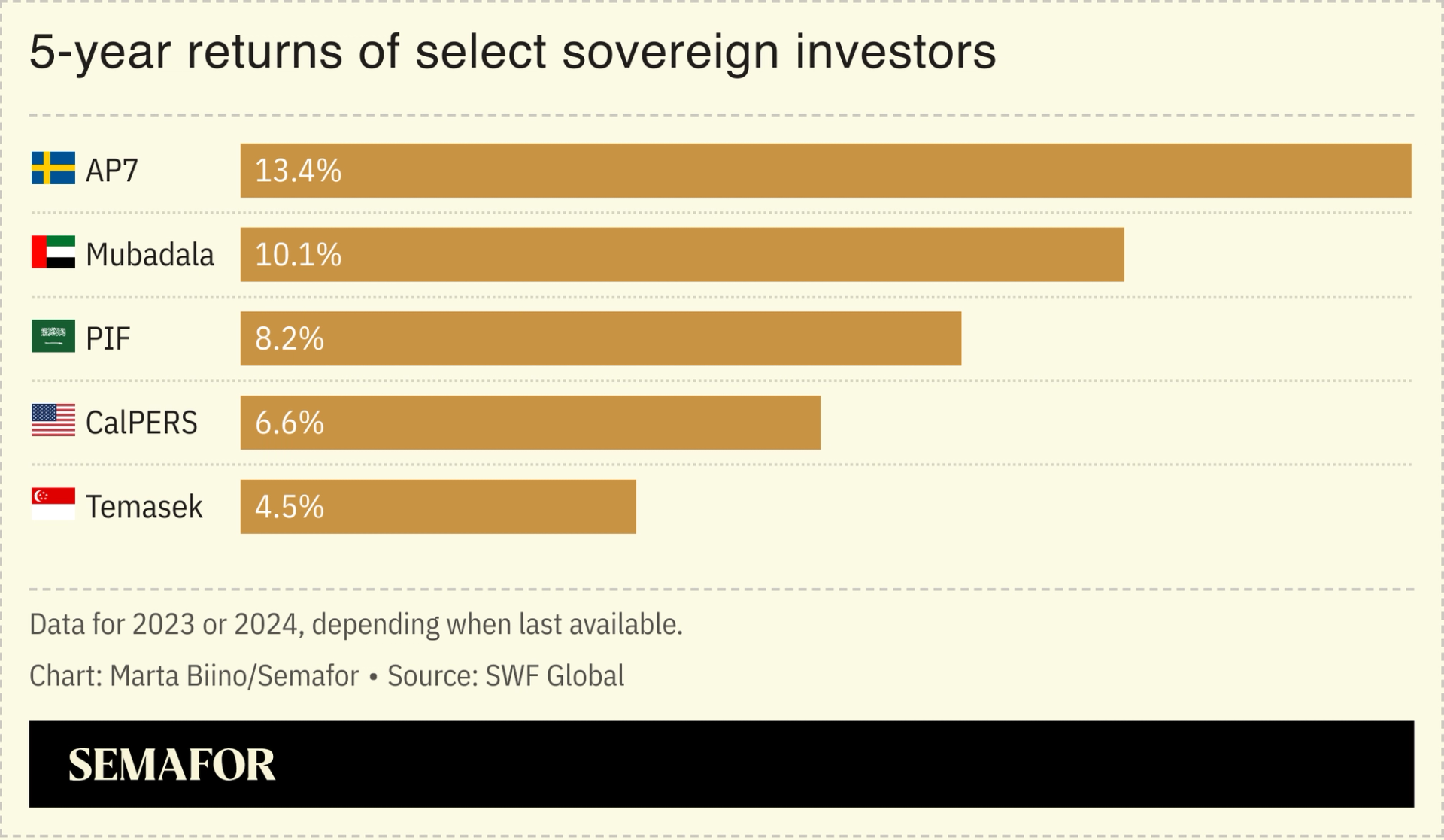

In an era where innovation and strategic acumen dictate the tide of financial markets, Mubadala Investment Company, Abu Dhabi’s second-largest sovereign wealth fund, stands out for its remarkable performance. The fund has deftly navigated the complexities of private credit markets and artificial intelligence (AI), positioning itself among the most successful sovereign wealth funds globally. Its latest annual report reveals that assets under management have soared to an impressive 0 billion, reflecting a robust 9.1% increase from the prior year. Moreover, with a five-year compounded annual return of 10.1%, Mubadala outpaces its competitors in the sovereign wealth sector, as highlighted by data from Global SWF.

Over the past few years, the investment landscape has witnessed significant shifts, particularly in the realms of private credit and technology. Private credit, often hailed as a resilient asset class, has captured the spotlight, leading to its recognition as the best-performing category for three consecutive years. Mubadala has committed approximately billion to this sector for 2024, directing funds towards partnerships with prominent U.S. firms such as Apollo, Ares, Carlyle, Goldman Sachs, and KKR. This strategic allocation not only exemplifies Mubadala’s forward-thinking approach but underscores its commitment to harnessing alternative investment avenues that promise stable returns amid fluctuating market conditions.

Mubadala’s foray into artificial intelligence marks yet another chapter in its illustrious investment narrative. As a founding partner of the MGX technology fund, alongside Abu Dhabi’s AI powerhouse G42, Mubadala aims to significantly expand its footprint in the tech space, with an ambitious target of reaching 0 billion in assets. This initiative speaks to a broader trend in which sovereign funds are increasingly seeking to capitalize on the burgeoning field of AI, which has the potential to revolutionize industries and reshape economic landscapes.

A noteworthy highlight of MGX’s activities includes its pivotal role in a landmark partnership involving BlackRock and Microsoft. This coalition is focused on injections of billion into developing data centers and energy infrastructures, predominantly in the United States. Such investments not only promise substantial financial returns but also align with global sustainability efforts, emphasizing the importance of environmentally responsible development in the technology sector.

Furthermore, MGX has played a crucial role in the 0 billion Stargate initiative, which had its inception under the Trump administration. Partnering with tech titans including OpenAI, SoftBank, and Oracle, Stargate aims to bolster AI infrastructure across various sectors, enhancing the United States’ competitive edge in an area that is rapidly becoming fundamental to economic growth and technological advancement.

Mubadala’s calculated and forward-looking investment strategy sets a precedent for sovereign wealth funds globally, particularly in regions known for their resource-rich portfolios. The UAE, and Abu Dhabi in particular, are redefining their roles on the global financial stage by moving beyond traditional investments in oil and gas, venturing into technological ecosystems that promise remarkable growth.

The importance of these investments transcends mere financial gain. They symbolize a broader vision for economic diversification, aiming to cultivate a knowledge-based economy in the Gulf region. As nations worldwide grapple with economic uncertainties, Mubadala’s performance shines a light on how strategic foresight combined with a willingness to embrace innovation can yield impressive results.

In conclusion, Mubadala Investment Company’s ascent in the sovereign wealth fund hierarchy reflects a well-executed strategy that leverages the synergies between private credit and cutting-edge technologies like AI. Their proactive approach not only enhances their asset base but also illustrates a commitment to sustainable and innovative investment practices. As they continue to shape the future of financial landscapes, the implications of their successes will reverberate through the global economy, providing a roadmap for other funds seeking to navigate the complexities of contemporary markets.

Tags: #BusinessNews, #EconomyNews, #UAE