Foreign Direct Investment: A Assessment of EU Stocks in 2023

The landscape of foreign direct investment (FDI) has undergone notable shifts in recent years, particularly for investors based in the European Union (EU). As per the latest data from Eurostat, the EU’s net foreign direct investment stocks held in non-EU countries reached an estimated €9.160 billion in 2023. This figure reflects a decline of 4.1% compared to the previous year, which recorded FDI stocks of €9.551 billion in 2022.

Accompanying this decline, investments originating from non-EU countries in the EU also witnessed a downward trajectory. The total FDI stocks held by non-EU residents in the EU decreased to €7.446 billion in 2023, marking a reduction of 5.4% from the €7.874 billion reported in 2022. Such trends indicate a potential cooling of international investment activity, possibly reflective of wider economic uncertainties.

Despite these declines, the EU’s net investment position concerning the rest of the world has remained relatively stable, with a slight increase of 2.2% compared to the prior year. This suggests that while individual investment stocks may be falling, the overall balance of FDI could suggest resilience in the EU’s economic framework.

A significant factor in these dynamics is the role of Special Purpose Entities (SPEs), which have become instrumental in managing foreign investments. By the close of 2023, SPEs constituted approximately 29% of the total EU FDI stocks held abroad and represented 33% of the FDI stocks possessed by non-EU countries within the EU. Such entities often serve as conduits for investment, facilitating international business operations, tax planning, and risk management.

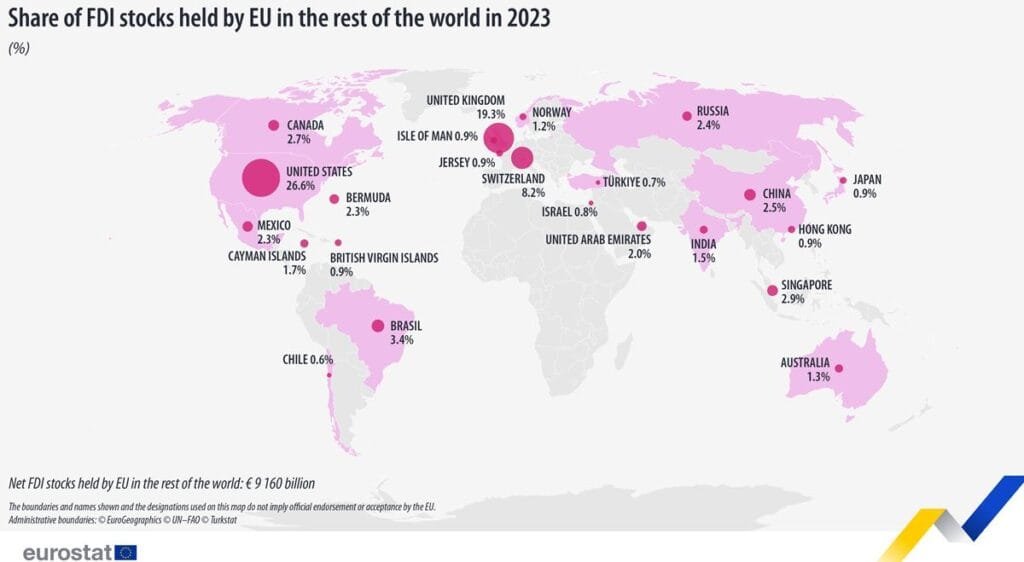

When examining the destinations of EU investments, the United States emerged as the primary beneficiary, absorbing 26.6% of total FDI stocks held by the EU in non-EU territories, amounting to approximately €2.437 billion. This was closely followed by the United Kingdom, which accounted for 19.3% (€1.765 billion) of EU FDI, confirming its ongoing importance as an investment destination even amidst geopolitical shifts post-Brexit.

Other noteworthy recipients of EU investments included Switzerland (€755 billion, 8.2%), Brazil (€312 billion, 3.4%), and Singapore (€263 billion, 2.9%). Additionally, Canada (2.7%), China (excluding Hong Kong) at 2.5%, Russia at 2.4%, Bermuda at 2.3%, Mexico at 2.3%, and the United Arab Emirates at 2.0% were also significant players, showcasing the diverse global investment landscape the EU engages with.

Conversely, FDI from the United States into the EU is also notable, with American direct investors holding stocks of approximately €2.299 billion, representing 30.9% of total FDI stocks within the EU. The UK and Switzerland also feature prominently in terms of FDI flows into the EU, with respective shares of 17.6% (€1.314 billion) and 8.3% (€620 billion). Other nations contributing over 2% included Canada (3.3%), Japan (2.9%), Hong Kong (2.1%), Russia (2.1%), and the British Virgin Islands (2.0%).

This intricate web of international investment underscores the EU’s critical role in the global economy and highlights the shifting allegiances and interactions between investor nations. As the world grapples with post-pandemic recovery and changing geopolitical landscapes, these investment trends will remain a focal point for policymakers and economists alike.

As the data unfolds, it is imperative for stakeholders—from businesses to governments—to closely monitor these trends. The implications span far beyond mere numbers, influencing job creation, economic growth, and international relations. Stakeholders must prepare for a more interconnected, yet uncertain, economic future, where foreign direct investments will play a crucial role in navigating the challenges ahead.

Tags:

#BusinessNews #EconomyNews #EU #ForeignDirectInvestment