Abu Dhabi's Sovereign Wealth Fund: A Steady Ascent in Global Finance

In the rapidly evolving landscape of global finance, Abu Dhabi’s sovereign wealth fund, the Abu Dhabi Development Fund (ADQ), has emerged as a significant player, continuing to scale new heights in asset management. As of October 2024, ADQ reported a remarkable total of 1 billion in assets. This figure represents an 11% increase from the previous assessment made by Global SWF in June of the same year. The impressive growth trajectory of ADQ indicates not just a robust capital influx but also the strategic foresight employed by the fund since its inception in 2018.

Originally established with 7 billion in capital—an endowment from the Abu Dhabi government—ADQ has expanded its investment portfolio to include key national entities such as Etihad Airways, the Emirates Nuclear Energy Company, and the Abu Dhabi Securities Exchange (ADX). Each of these investments underscores the fund’s commitment to bolstering sectors that are essential to the UAE’s economic diversification efforts.

In a broader context, Abu Dhabi’s financial dominance has been further solidified by its recent accolades. Labelled the world’s richest city in terms of assets managed by sovereign wealth funds, Abu Dhabi overtook Oslo in 2023, amassing a staggering .7 trillion in assets. This monumental achievement cements the emirate’s status as a crucial hub for global investment, attracting capital not only within the Middle East but also across international markets.

The government’s promotion of Abu Dhabi as the “capital of capital” aligns with its long-term strategic vision to transform the emirate into a financial powerhouse. This branding effort resonates with potential investors worldwide, who are increasingly looking toward the Gulf region as a sustainable and lucrative investment environment. The consolidation of various institutions, alongside a concerted push for transparency and regulatory reforms, has significantly enhanced Abu Dhabi’s appeal as a destination for sovereign wealth funds.

ADQ’s operational strategies reflect a deliberate shift towards capturing high-growth sectors, further evidenced by its diversification efforts into technology, renewable energy, and healthcare. As part of its long-term vision, the fund seeks to align investments with global trends, which include an increasing focus on sustainability and environmental consciousness. The 2021 establishment of its dedicated Sustainability Fund exemplifies this initiative, which aims to invest in ventures that contribute positively to environmental outcomes while generating robust returns.

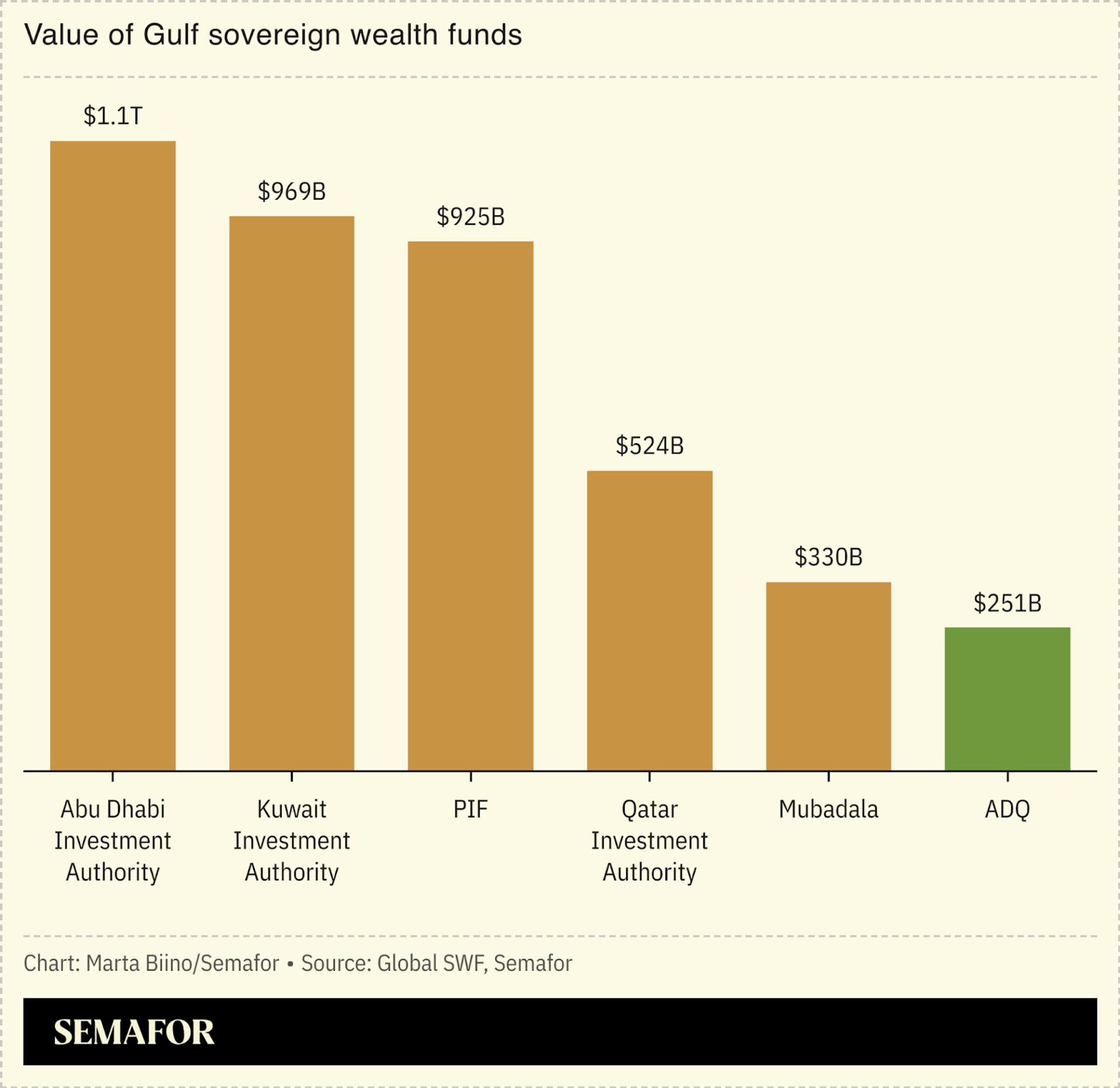

Moreover, the growth of ADQ points to a broader trend within the GCC region, where sovereign wealth funds are becoming increasingly proactive in pursuing international investment opportunities. Funds like the Public Investment Fund of Saudi Arabia and the Kuwait Investment Authority are similarly expanding their footprints globally, signifying a collective shift toward diversified portfolios and strategic alliances. Such advancements not only enhance the financial stability of these nations but also position them favorably on the global stage.

Looking ahead, the resilience of Abu Dhabi’s economic framework, buttressed by its solid financial institutions and a government committed to fostering sustainable development, places ADQ in a favorable position for future growth. The ongoing pursuit of innovation and technological excellence, propelled by significant investments in education and skill development, is expected to yield positive returns in the coming years.

In conclusion, the impressive ascent of ADQ and Abu Dhabi’s burgeoning reputation as a global financial nexus serves as a testament to the emirate’s strategic initiatives and economic foresight. With its commitment to diversification, sustainability, and innovation, Abu Dhabi is poised not only to maintain its financial prowess but also to inspire other nations within the region to harness their wealth for productive, impactful investments in the future.

Tags: #BusinessNews, #EconomyNews, #UAE, #AbuDhabi, #RealEstateNews, #StartupsEntrepreneurship